Who we are.

We specialise in designing and manufacturing professional lighting systems. We currently employ over 900 people and, although each company works autonomously, our skills and markets are complementary.

Our purpose.

Provide technically advanced lighting solutions that deliver long-term lowest cost of ownership.

Our vision.

Maintain a consistently respected and profitable organisation with an environmental conscience.

Our values.

Demonstrating our company values.

Our employees are fundamental to our success; they design, develop, manufacture and sell our products, as well as provide the excellent customer service we deliver. In return, we invest in them with development and training, and we have a wellbeing policy. We also have an apprentice scheme, and we train and promote management from within the Group.

Mike Allcock

Chairman

Our investment case.

Product innovation...

Product design and development is fundamental to our operations.

£2.0m(2023: £1.9m)

Group spend on capitalised R&D this year

The all new Firefly range.

The new Firefly combines a discreet recessed downlight with the SmartScan wireless emergency system for a reliable solution that is easy to install and maintain. Developed collaboratively by Thorlux Lighting, Philip Payne, Famostar and Zemper, the new Firefly integrates advanced lithium battery technology with enhanced optical performance ensuring compliance and safety in buildings.

Our focus on sustainability...

Environmental issues are a significant focus for us.

479 tonnes

of CO2e saved from solar panels

Circularity in lighting.

As we face the depletion of the Earth’s finite resources, FW Thorpe recognises the need to shift away from the traditional linear economy of take, make and dispose. Instead, the Group embraces the circular economy, which focuses on eliminating waste and keeping products and materials in use for as long as possible through refurbishment and recycling.

The Thorlux Light Line retrofit solution scored 2.9 in the TM66 circular economy assessment. In April 2024, TRT made history with its Oaken streetlight, scoring 3.1 – the highest for any luminaire in the TM66 Assured scheme. The Oaken luminaire, made from recycled polycarbonate and aluminium, is housed in an oak body.

By integrating circular principles like efficiency and longevity into the designs, the Group not only reduces environmental impact but also opens new opportunities for remanufacturing and retrofitting.

And strong financial performance...

We achieved an improved financial performance over this year despite challenging economic conditions.

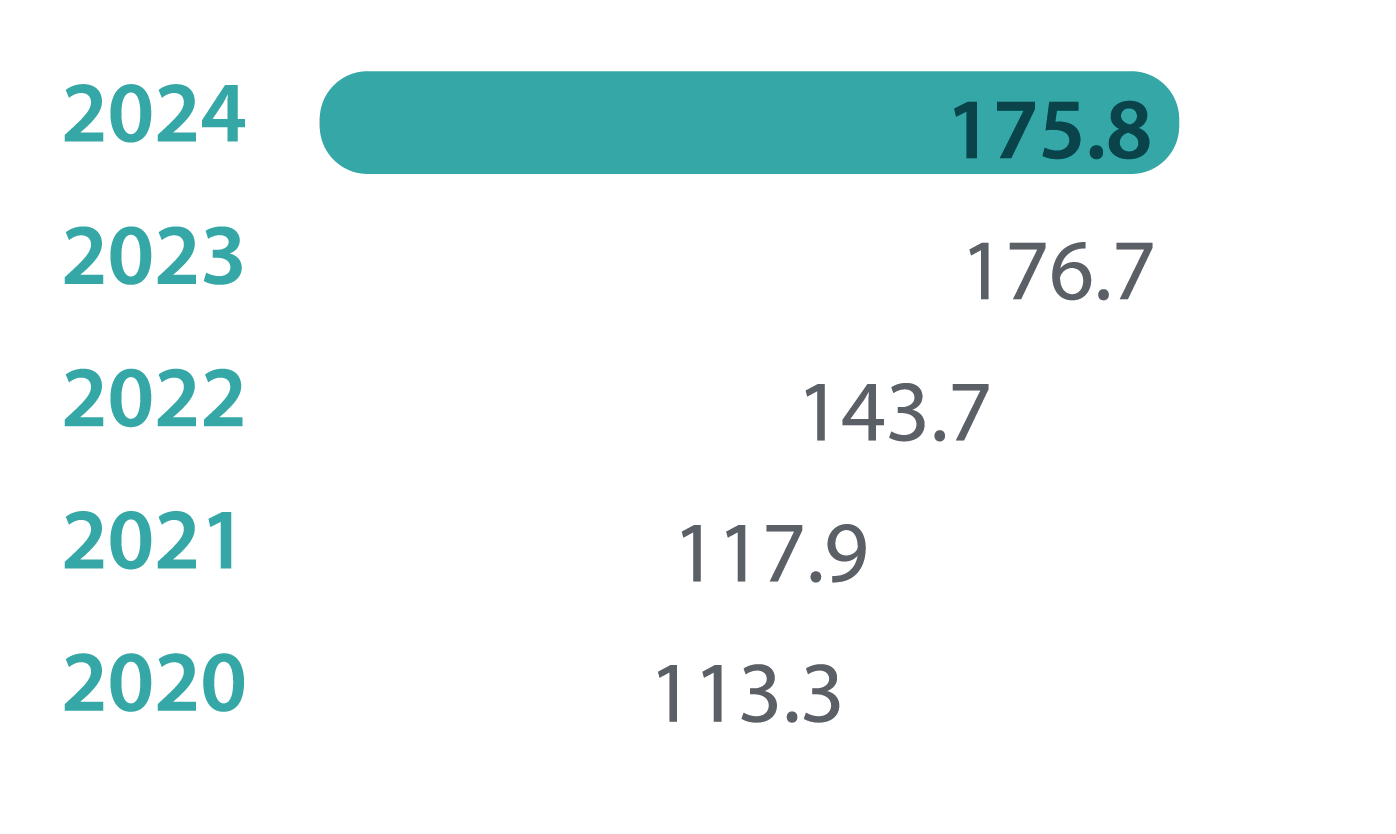

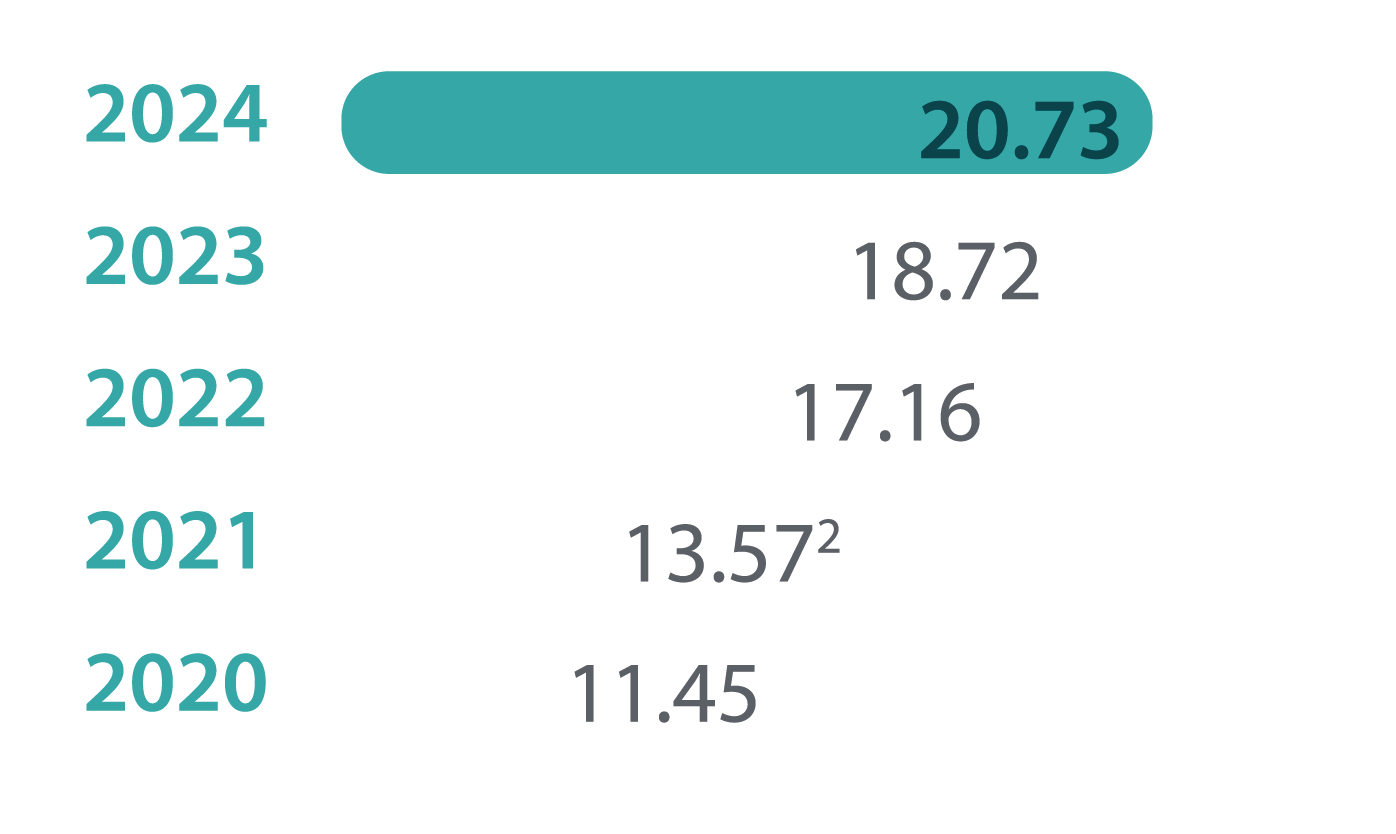

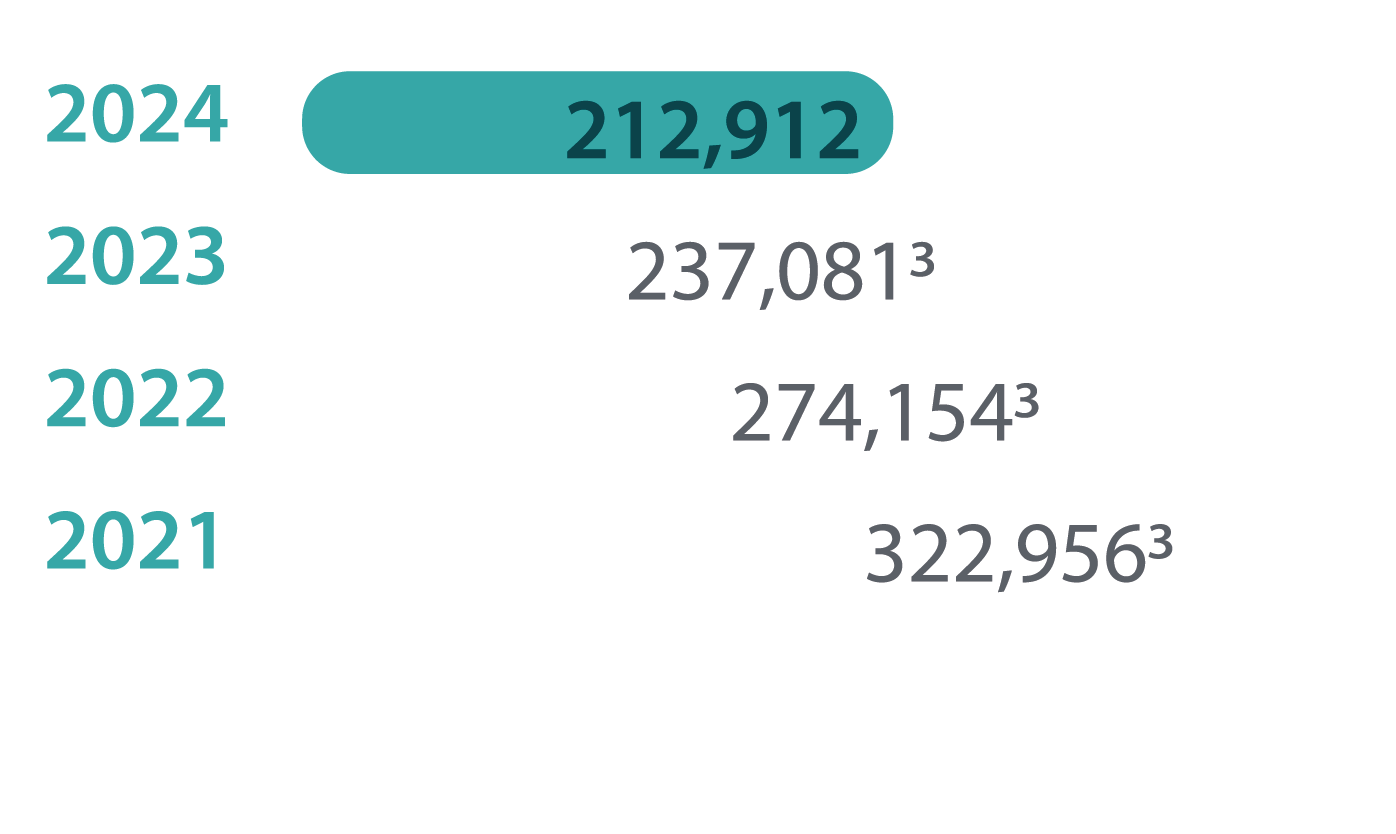

Revenue (£m)

-0.5%

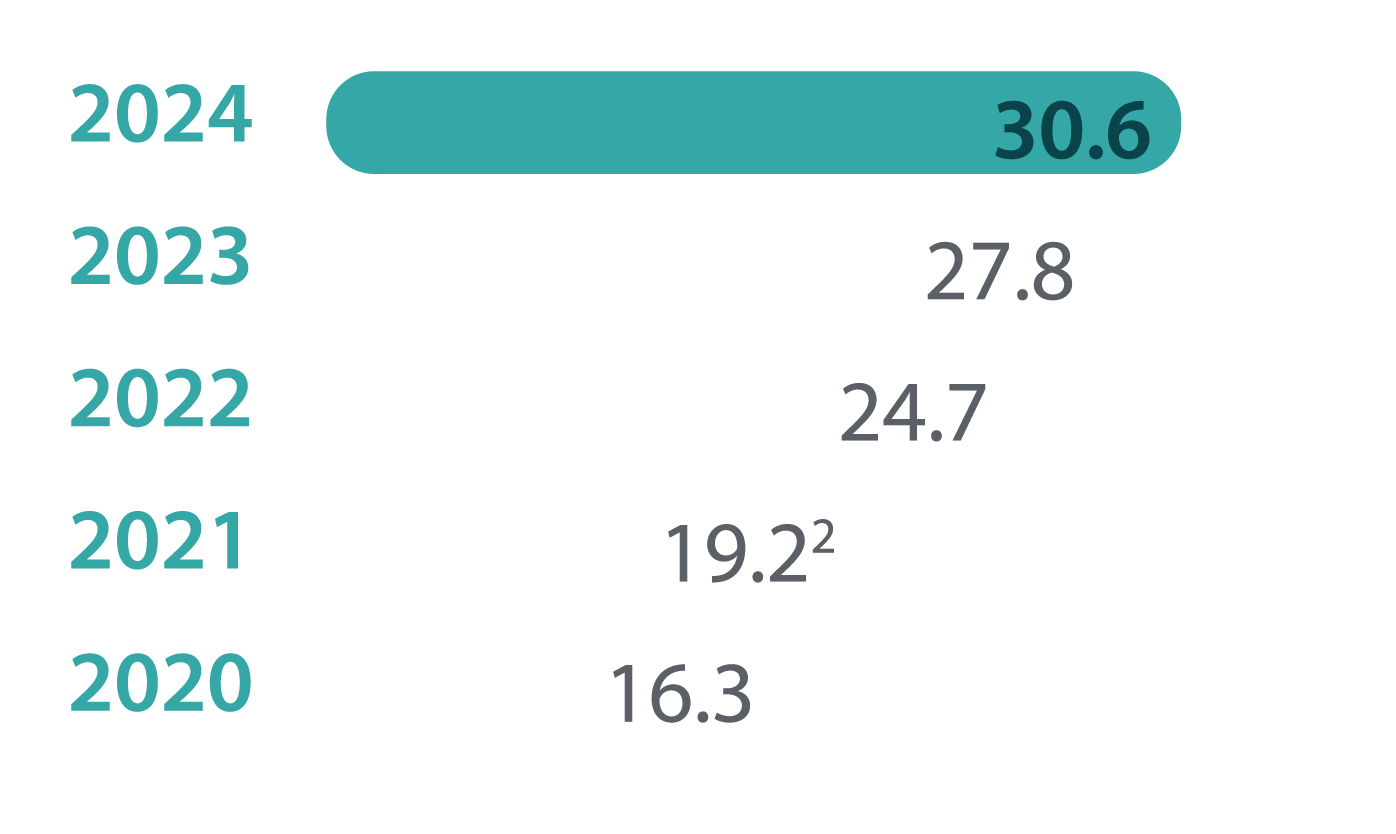

Operating profit (£m)

+10.1%

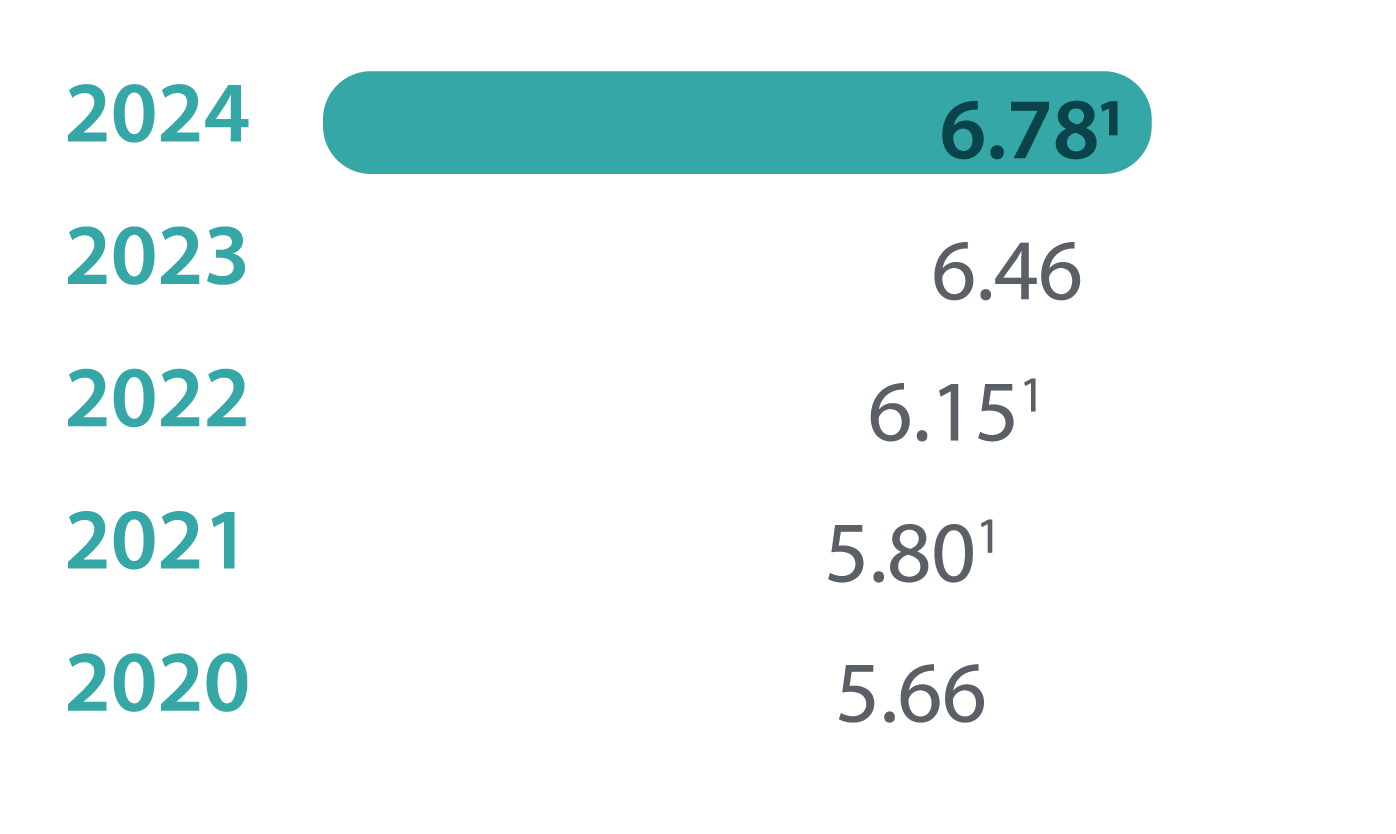

Dividend per share (pence)

+5.0%

Basic earnings per share (pence)

+10.7%

CO₂ emissions (tCO₂) (Scopes 1,2 and 3)

-10.2%

Notes

2024, 2022 and 2021 dividends exclude special dividends

2021 excludes the exceptional items in respect of Lightronics fire £1.6m

Restated to include SchahlLED

Means we are positioned for sustainable, long-term growth...

Providing long-term value for us and for our stakeholders.

£41.4m(2023: £31.9m)

Net cash generated from operating activities

Our sustainability journey.

Our sustainability journey.

The Group is committed to addressing today’s sustainability challenges and opportunities, adjusting its business strategy accordingly. Understanding the needs of customers and key stakeholders and the expectations they have is central to ensuring that the Group prioritises the most critical issues and operates a responsible and sustainable business.

Thorlux carbon offsetting project

Since 2009, FW Thorpe has been planting trees on its own land in Wales to offset Group emissions annually. The Group has planted 179,412 trees, effectively offsetting more than 44,385 tonnes of CO₂e emissions over the next 100 years.

Operational performance.

Our performance explained.

Following a few years of significant organic and acquisitive growth, this year has been one of consolidation."

Craig Muncaster

Chief Executive, Group Financial Director and Company Secretary